What is a Reverse Mortgage?

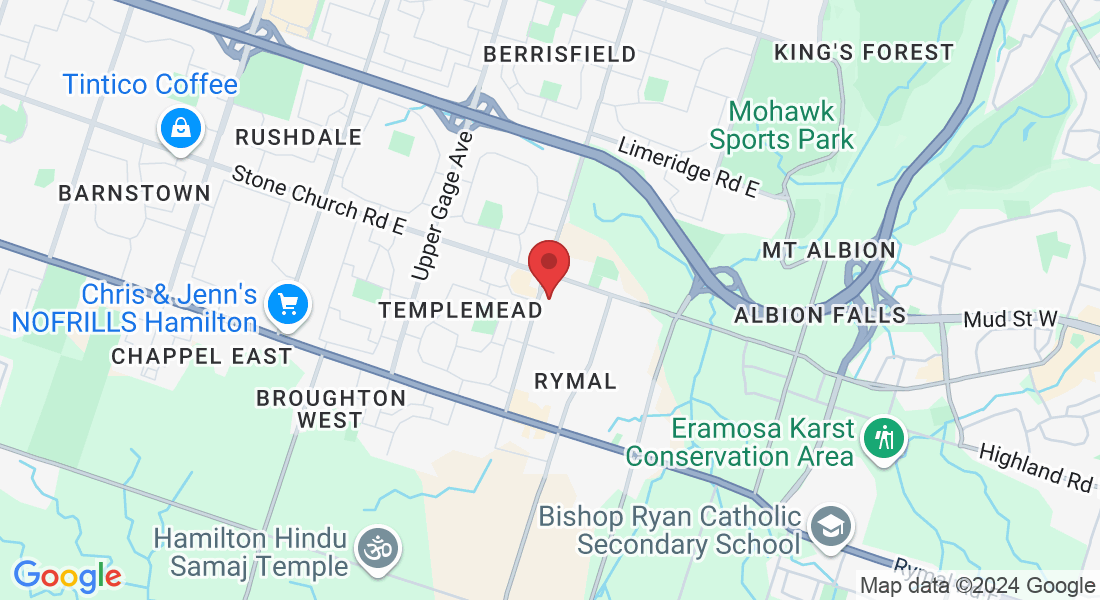

A reverse mortgage is a loan that allows you to get money from your home equity without having to sell your home. You may be able to borrow up to a certain percentage of the current value of your home. The maximum amount you will be able to borrow will depend on your age, your home’s appraised value, the lender and the type of property you have. You don’t need to make any payments on a reverse mortgage until the loan is due. This is usually when you move out of your home, sell it or the last borrower dies. You will owe more interest on a reverse mortgage the longer you go without making payments. This may result in you having less equity in your home. How do you start the process of getting a reverse mortgage, a good place to start to learn about a reverse mortgage is to download our free

Reverse Mortgage Guide for Canadian Retirees.

Eligibility for a Reverse Mortgage

To be eligible for a reverse mortgage, you must be:

a homeowner or looking to buy a home

at least 55 years oldIf you have a spouse and you are both on the title for your house, both of you must be listed on the reverse mortgage application. Both of you must be at least 55 years old to be eligible for a reverse mortgage.

The home you’re using to secure a reverse mortgage must also be your primary residence. This usually means you live in the home for at least six months a year.

If you have a mortgage on your house you must pay it off when you get a reverse mortgage. You can use the money you get from a reverse mortgage to pay any mortgage, debt or lien against your house.

Qualifying for a reverse mortgage

When you apply for a reverse mortgage, your lender will consider:

your age, and the age of your spouse even if they are not registered on the title of your house

where you live,your home’s condition, type and appraised value

In general, the older you are and the more home equity you have when you apply for a reverse mortgage, the more money you could get. Current market trends will also impact how much money you could get.

Your lender may ask you and your spouse to show proof that you received independent legal advice before you get a reverse mortgage.

If you would like to know how much of a reverse mortgage you qualify for simply complete the Free Assessment

information and we will send you an estimate of how much you can get on your current home or the property you are looking to purchase.

"I want to enjoy my retirement, How do I begin the process?"

A Great place to start is to educate yourself about the process and the costs of setting up A reverse mortgage in Canada get the free Reverse Mortgage Guide for Canadian Retirees to start learning about them.

"We have enough income every month, but we want to give some money to our children, can we use a reverse mortgage to do this?"

Yes you certainly can use it for that purpose and quite a few Retirees set up a reverse mortgage for exactly this reason.